rhode island tax table 2019

It kicks in for estates worth more than 1648611. 1 See Rhode Island Public Law 2016 ch.

Schedule CR - Other Rhode Island Credits.

. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. One Capitol Hill Providence RI 02908. Find your income exemptions.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. Printable Rhode Island state tax forms for the 2020 tax year will be based on income earned between January 1 2020 through December 31 2020. Check the 2019 Rhode Island state tax rate and the rules to calculate state income tax.

However if Annual wages are more than 221800 Exemption is 0. The Rhode Island State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket. Applied to formulas under Rhode Island General Laws 44-30-26. The same is true for personal exemptions and dependency exemptions.

The Rhode Island State Tax Tables for 2017 displayed on this page are provided in support of the 2017 US Tax Calculator and the dedicated 2017 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Rhode Island personal and dependency exemption amounts by tax year 2019 2020 4100 4150 Most taxpayers are able to claim the full amount of their applicable standard deduction. 2019 Tax Rate Schedule.

2019 Social Security Worksheet for line 1u of RI Schedule M. Exemption Allowance 1000 x Number of Exemptions. Find your pretax deductions including 401K flexible account contributions.

Find your gross income. The state income tax table can be found inside the Rhode Island 1040 instructions booklet. For married taxpayers living and working in the state of Rhode Island.

Find your gross income. The Rhode Island State Tax Tables for 2016 displayed on this page are provided in support of the 2016 US Tax Calculator and the dedicated 2016 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax Table.

Rhode Island annual income tax withholding tables percentage method for wages paid on or after January 1 2019. The income tax is progressive tax with rates ranging from 375 up to 599. Find your income exemptions.

However if a taxpayers federal. Schedule M - Rhode Island Modifications to Federal AGI. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

Tax rate of 599 on taxable income over 148350. Resident Tax Return Microsoft Word - Incentive and Credit Overview for DLT State of Rhode Island Division of Taxation 2021 Form RI-1040 21100199990101 Resident Individual Income Tax Return Spouses social security number Your social security number Your first name MI Last name Suffix Spouses name MI Last name Suffix Address City town or post office State ZIP code City or. The 2019 Form RI W-4 which the employer is required to keep on file is included in the 2019 employer withholding booklet and available separately here.

RHODE ISLAND TAX RATE SCHEDULE 2019 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 64050 145600 But not over Pay--of the amount over 240188. Tax rate of 375 on the first 65250 of taxable income. 13 16 codified at Rhode Island General Laws 44-30-12.

RIDivision of Taxation One Capitol Hill Providence RI 02908-5806. The top rate for the Rhode Island estate tax is 16. Rhode Island Standard Deduction Single 8750 Married filing jointly or Qualifying widower 17500 Married filing separately 8750 8 Head of household 13100.

RETURNMUSTBESIGNED - SIGNATUREISLOCATEDONPAGE2 Mailing address. Subscribe for tax news. Directions Google Maps.

However if Annual wages are more than 215800 Exemption is 0. The Rhode Island Department of Revenue is responsible for. Tax rate of 375 on the first 65250 of taxable income.

Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Rhode Island for single filers and couples filing jointly. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

Schedule U - Individual Consumers Use Tax Microsoft Word - Incentive and Credit Overview for DLT State of Rhode Island Division of Taxation 2021 RI Schedule U 21101699990101 Individual Consumers Use Tax Names shown on Form RI-1040 or RI-1040NR Your social security number Individual Consumers Use Tax Worksheet NOTE. The steps in computing the income tax to be withheld are as follows. Tax rate of 475 on taxable income between 65251 and 148350.

When reporting the amount of use tax. Exemption Allowance 1000 x Number of Exemptions. The Rhode Island income tax rate for tax year 2020 is progressive from a low of 375 to a high of 599.

Rhode Island Tax Table 2019 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 0 50 100. If you live in Rhode Island and are thinking about estate planning this guide has the information you need to get started but professional help in the form of a financial advisor can help you whether your planning an estate or dealing with any other financial. Schedule U - Individual Consumers Use Tax.

Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. Rhode Island Division of Taxation. The Rhode Island Department of Revenue is responsible for.

Find your pretax deductions including 401K flexible account contributions. 4 Federal AGI from Federal Form 1040 or 1040-SR line. The modification first The modification first appeared on Division of Taxation forms in early 2018 covering the 2017 tax year.

The Rhode Island Department of Revenue is responsible for.

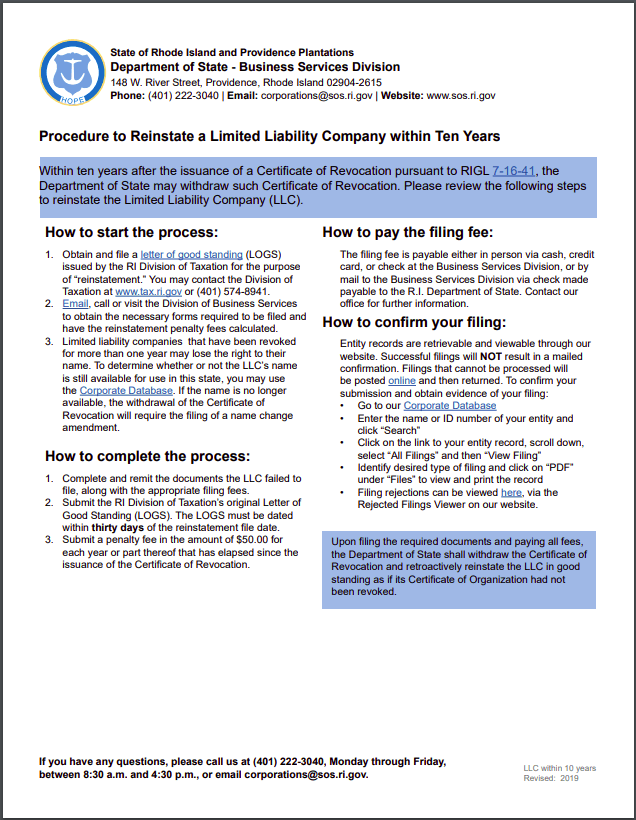

Free Guide To Reinstate Or Revive A Rhode Island Limited Liability Company

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Rhode Island Division Of Taxation 2019

Rhode Island Division Of Taxation 2019

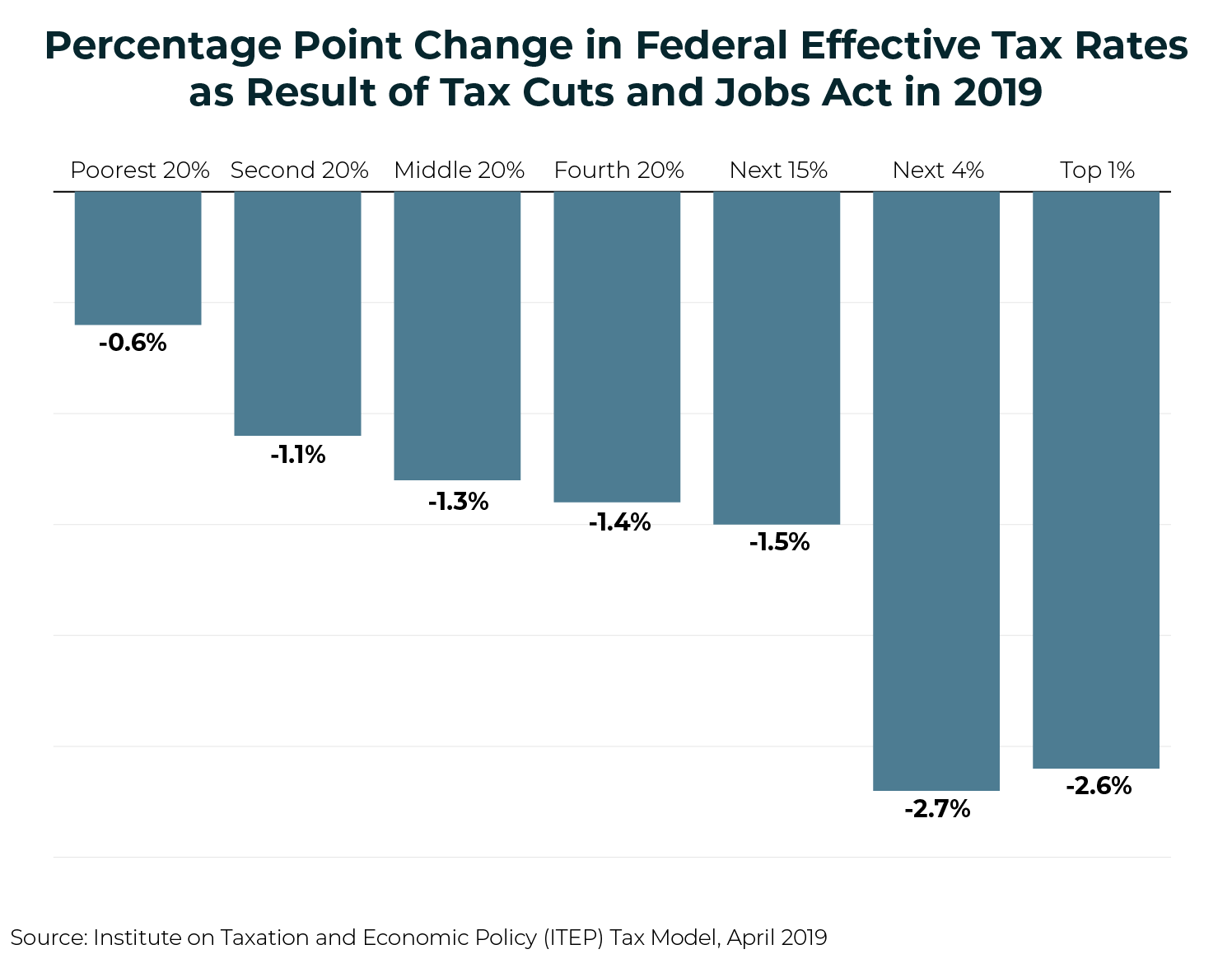

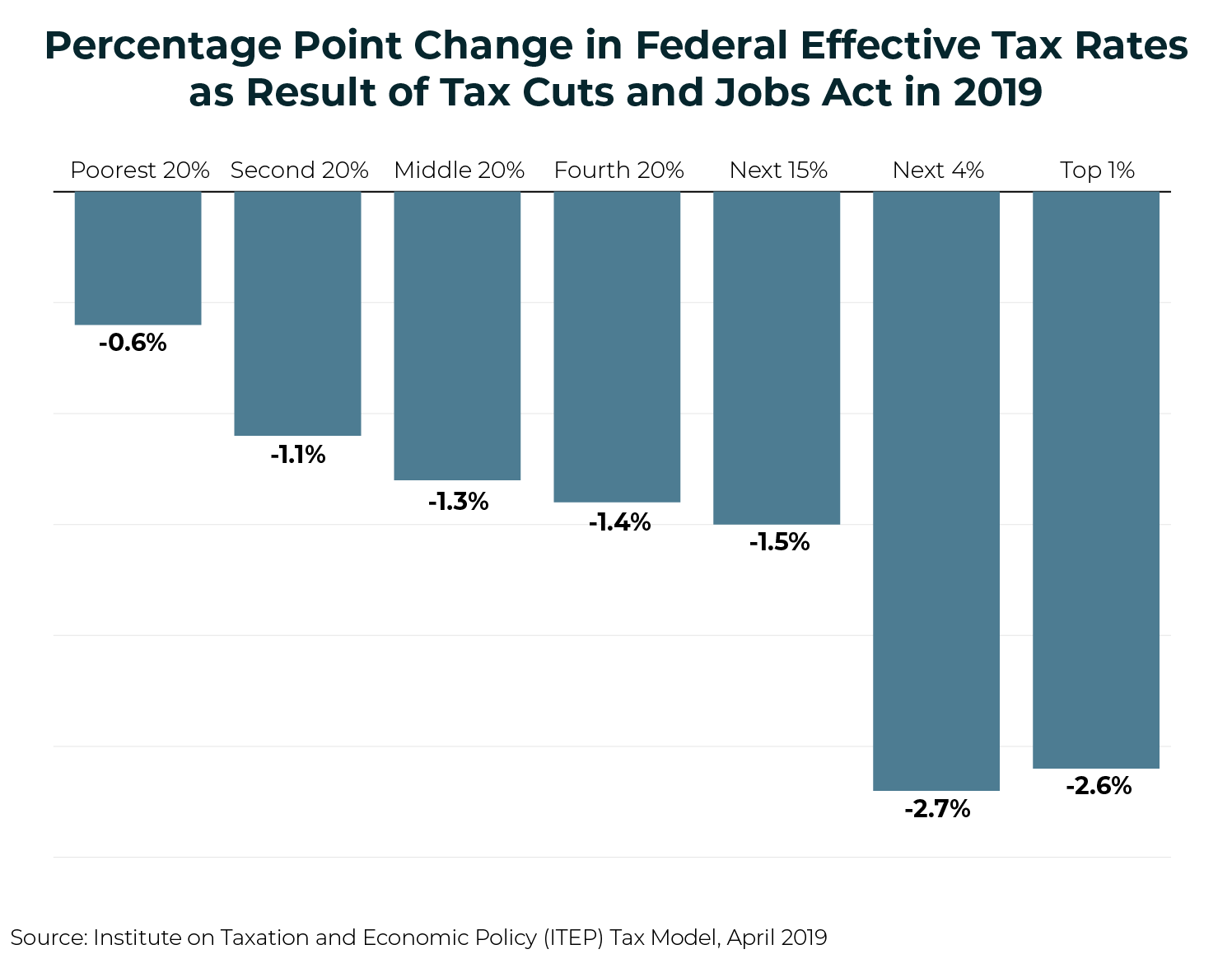

Who Pays Taxes In America In 2019 Itep

Ri Online Sports Betting Sportsbook Rhode Island Now Live Online

Rhode Island Income Tax Brackets 2020

Who Pays Taxes In America In 2019 Itep

Solved I M Being Asked For Prior Year Rhode Island Tax

Rhode Island Division Of Taxation 2019

Rhode Island Division Of Taxation 2019

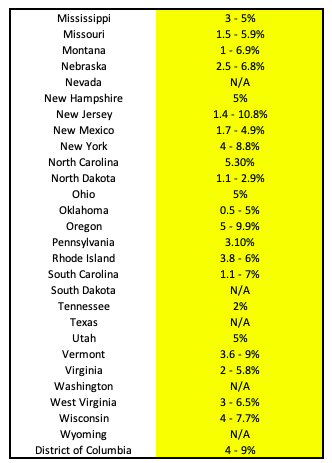

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

Colorado Income Tax Rate And Brackets 2019